Copy Trading & PAMM/MAM Accounts – Due Diligence, Fee Models and Hidden Risks

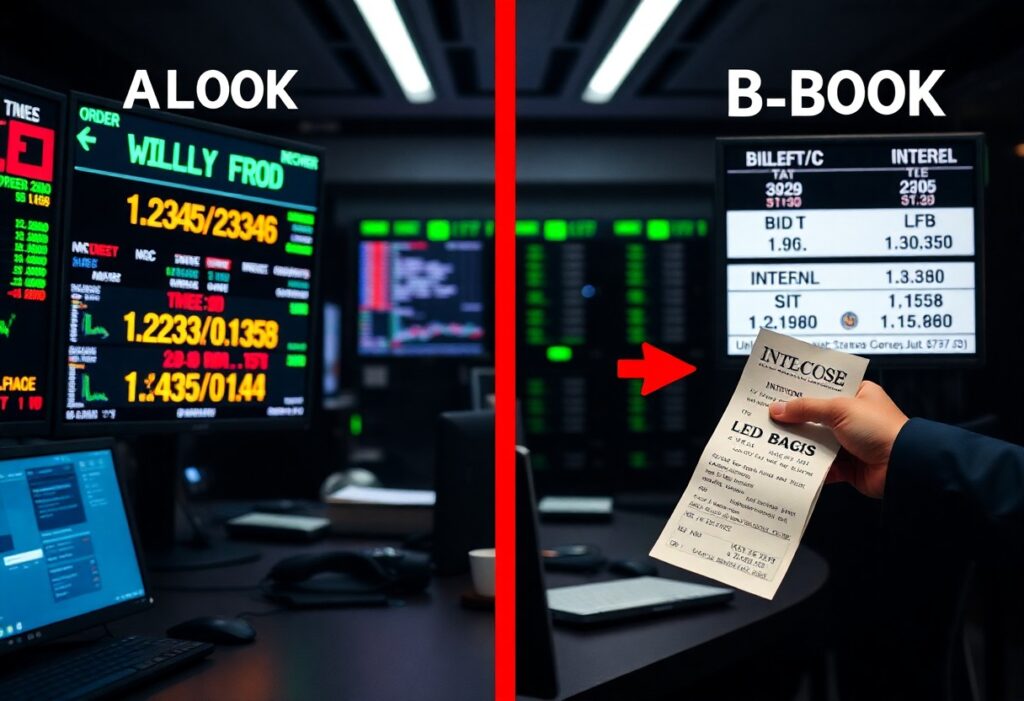

Most investors are attracted to copy trading and PAMM/MAM accounts for passive exposure, but you must perform rigorous due diligence on manager track records, risk controls and regulation; scrutinize performance fees, spreads and withdrawal terms to avoid opaque fee traps; and recognize that slippag...